Retirement Planning For Individuals Over Age 50

Reduce Taxes | Invest Smarter | Optimize Income

Whether it's spending more time with family, traveling, or pursuing a hobby or a calling, you can do it without worrying about running out of money or cheating yourself out of what you could have enjoyed.

Start Here for Free Assessment JT Stratford Disclosures & Form CRS********************************************************************************

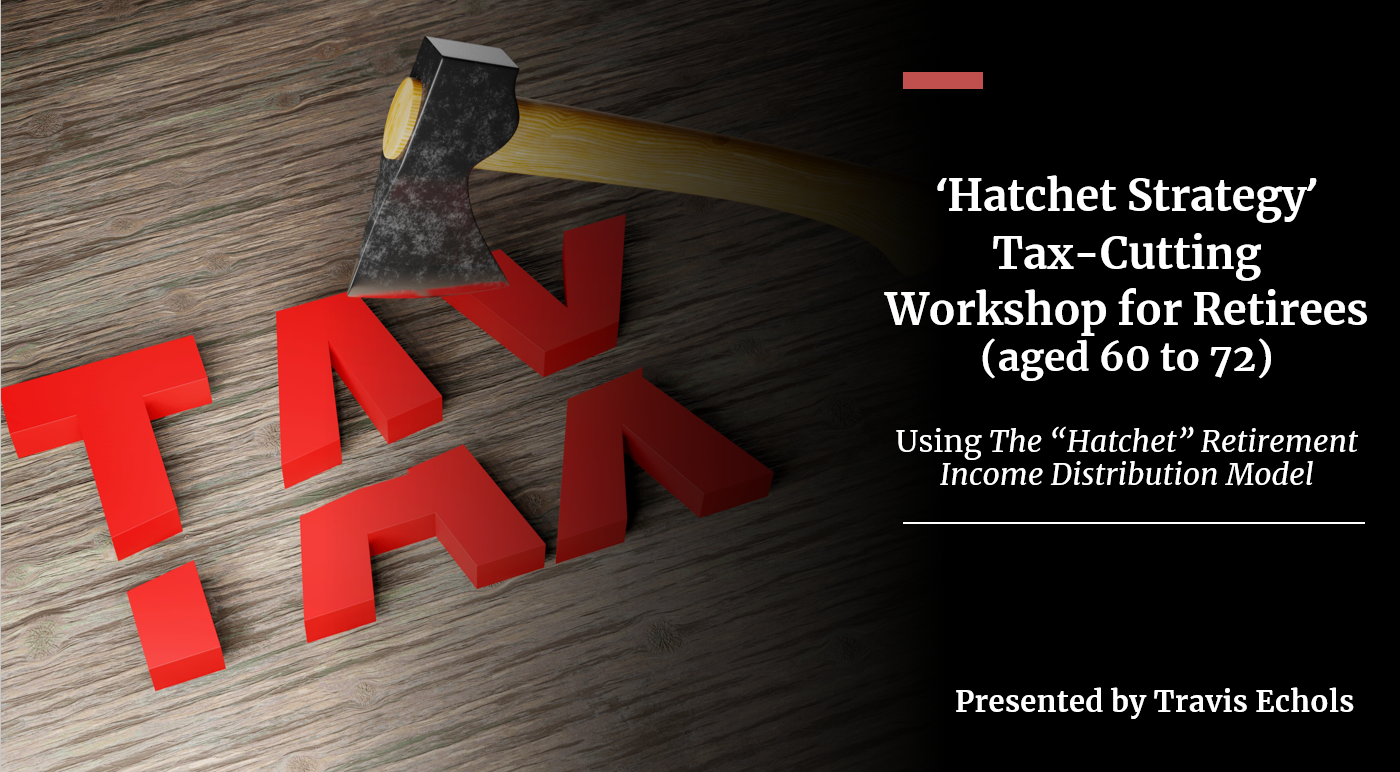

Live and In-Person Educational Workshop

"Slash Your Retirement Taxes"

Join Our Free Tax-Cutting Workshop (ages 60 to 72)

********************************************************************************

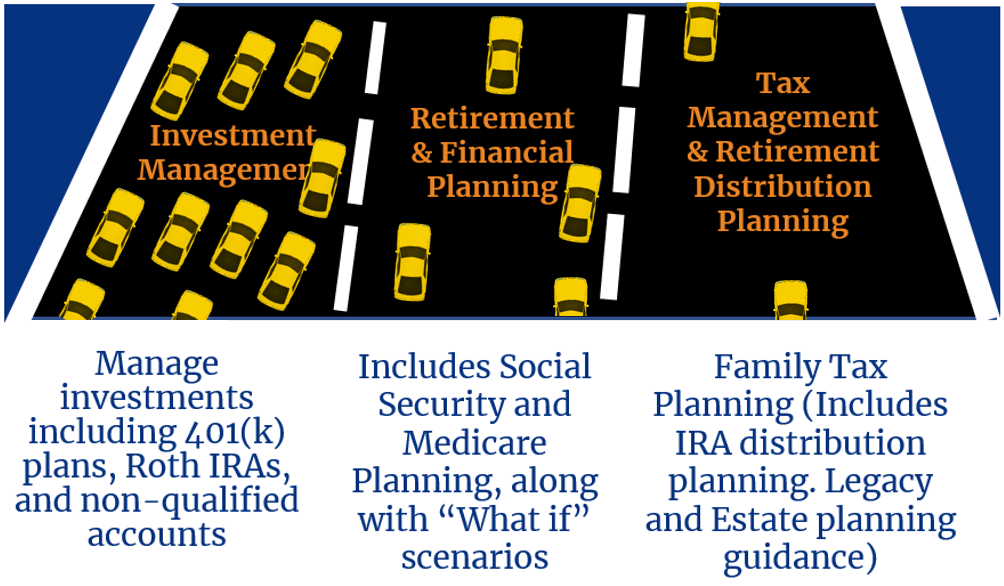

Tax Planning for Retirement Sets Us Apart

Travis Echols

A vital part of financial planning for retirees is tax planning. Yet so few retirees get any meaningful tax planning. As a result, many retirees get stuck overpaying the IRS year after year…and then, to make it worse, leave their heirs with a big tax problem.

For clarity, let’s be sure to differentiate tax preparation from tax planning. Tax preparation, also called tax return preparation, typically looks backward, one year at a time, to submit the proper tax forms and accurately calculate your tax liability (and how much you owe or overpaid).

Tax planning, on the other hand, looks at taxes in the context of your overall financial picture. A tax planner not only looks in the rearview mirror but will look forward 20 to 30 years at your projected tax liability and ask what can be done to lower your lifetime tax bill.

My goal is to bring to your attention effective tax planning strategies to coordinate with your tax preparer to reduce your lifetime taxes. By anticipating taxes, it is possible to significantly increase how much money you will have in retirement. And every dollar saved in taxes is a dollar to fund your dreams and goals.

So, do you think that it would be a good idea to consider the tax consequences of a transaction before the transaction takes place? If you answer yes, I agree. Next question. How often does your advisor look at your tax return? How would they know the tax consequences of their recommendations if they are not looking at your tax return?

Good tax planning is one of the key areas of retirement success. If you are retired or close to retiring, and especially if you have large retirement accounts, you need an advisor who includes this important aspect of financial planning in their practice. It could save you tens or hundreds of thousands of dollars in lifetime taxes. Read more...

There are many so-called “advisors”. Fewer focus solely on retirement strategies. Even fewer master tax planning for retirees because this requires a significant investment of time and dollars to have the expertise and tools to do this very technical, customized work that is not so easily scalable.

To gain more insight into the potential of these tax reduction strategies,

register for your Online Masterclass "How to Take a Hatchet to Your Retirement Taxes"

and watch now or schedule to watch later.

The Lonely Lane of Tax Planning for Retirees

Are you on the hunt for the best Financial Advisor?

Our latest comprehensive guide for consumers highlights the 8 Crucial Questions you need to ask.

8 Questions to Ask When Hiring a Financial Advisor

Plus get a free ticket to Travis's training resources and emails to help you retire with success and confidence.

Privacy Policy: Your information is 100% secure.

RETIREMENT PLANNING

TAX PLANNING

INVESTMENT MANAGEMENT

SOCIAL SECURITY TIMING

RETIREMENT INCOME

OPTIMIZING INSURANCE